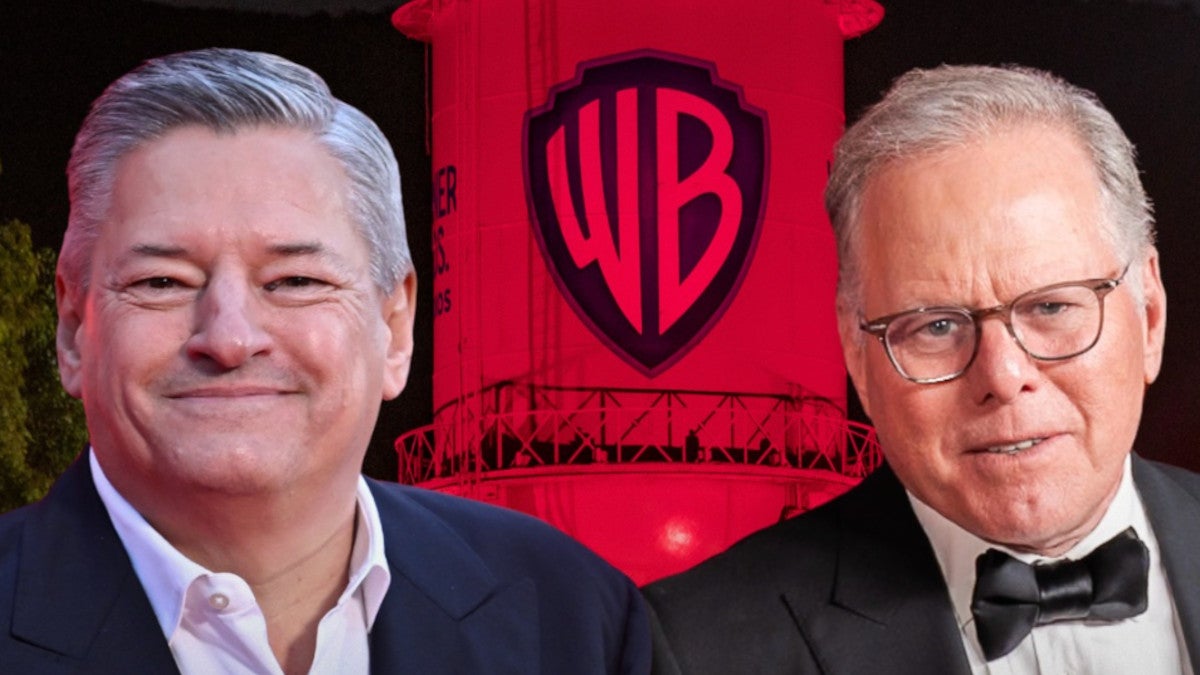

Netflix Revises Warner Bros. Discovery Deal to $27.75 Per Share, All-Cash Offer

Netflix has revised its $83 billion deal for Warner Bros. Discovery’s studio and streaming assets to an all-cash transaction in an effort to simplify its structure, provide “greater certainty of value,” and accelerate the path to a vote by WBD shareholders by April.

The all-cash transaction continues to be valued at $27.75 per share. WBD stockholders will also receive additional value from shares of Discovery Global, Warner’s cable network spinoff that will take place in six to nine months.

The Netflix deal will be financed through a combination of cash on hand, available credit facilities and committed financing. Wells Fargo, BNP and HSBC are serving as the lead arrangers for the debt financing related to the transaction.

“Today’s revised merger agreement brings us even closer to combining two of the greatest storytelling companies in the world and with it even more people enjoying the entertainment they love to watch the most,” Warner Bros. Discovery CEO David Zaslav added. “By coming together with Netflix, we will combine the stories Warner Bros. has told that have captured the world’s attention for more than a century and ensure audiences continue to enjoy them for generations to come.”

“Our revised all-cash agreement demonstrates our commitment to the transaction with Warner Bros. and provides WBD stockholders with an accelerated process and the financial certainty of cash consideration, while maintaining our commitment to a healthy balance sheet and our solid investment grade ratings,” Netflix co-CEO Greg Peters added. “We will continue to work closely with WBD to successfully complete the transaction as we remain focused on our mission to entertain the world and, together, define the next century of storytelling.”

In December, Netflix and WBD agreed to a cash-and stock-deal, which was comprised of $23.25 in cash and $4.50 in stock, subject to a collar of $97.91 to $119.67 per share based on Netflix stock’s 15-day volume weighted average price (“VWAP”). But shares of Netflix have fallen below the collar, with the stock trading at $88 per share as of Monday’s close.

In addition to volatility in its stock price, Netflix’s deal with Warner Bros. has been challenged by a $30 per share, all-cash hostile takeover bid from Paramount, which would acquire the entire company, inclusive of its cable networks.

Paramount’s $108.4 billion bid is backed by Oracle co-founder Larry Ellison’s irrevocable personal guarantee towards $40.4 billion of the equity financing, and $55 billion in debt financing from Bank of America, Citigroup and Apollo Global Management. Its other equity partners include RedBird Capital Partners and three Middle Eastern sovereign wealth funds.

Paramount, which has sued to obtain additional disclosure around how the Netflix deal and Discovery Global spinoff were valued, has argued that the latter’s equity value ranges between nothing and 50 cents.

In a new regulatory filing on Tuesday, WBD valued Discovery Global’s equity between as little as $1.33 per share and as high as $6.86 per share in the event the company is acquired following the separation. The new Netflix deal also reduced the amount of Warner’s debt being placed on Discovery Global by $260 million due to better-than-expected cash-flow performance of the business last year.

“Our amended agreement with Netflix is a testament to the Board’s unrelenting focus on representing and advancing our stockholders’ interests,” WBD board chairman Samuel A. Di Piazza, Jr. said in a statement. “By transitioning to all-cash consideration, we can now deliver the incredible value of our combination with Netflix at even greater levels of certainty, while providing our stockholders the opportunity to participate in management’s strategic plans to realize the value of Discovery Global’s iconic brands and global reach. We look forward to continuing to engage with our investors about the compelling benefits of the transaction as we progress toward our stockholder vote on an accelerated timeline.”

Paramount’s tender offer is set to expire on Wednesday at 5 p.m. ET, though that deadline is expected to be extended after a Delaware judge dismissed its motion to expedite proceedings in its lawsuit against Warner Bros. Discovery. As of Dec. 19, less than 400,000 WBD shares had been validly tendered to Paramount Skydance.

The amended, all-cash deal, which was unanimously approved by Netflix and WBD’s boards of directors, represents a premium of 121% to WBD’s stock price of $12.54 prior to reports that Paramount planned to make an offer to acquire WBD and a 100% premium to WBD stock’s 52-week high.

Closing remains subject to completion of the Discovery Global separation, receipt of required regulatory approvals, approval of WBD stockholders and other customary closing conditions.

Both Paramount and Netflix are currently engaging with regulators, including the Department of Justice and European Commission. Netflix reiterated that it expects a deal to close within 12 to 18 months from when the deal was first announced, while Paramount has said a potential deal would close within a year.

If Warner Bros. abandons the deal with Netflix, it would be required to pay the streamer a $2.8 billion termination fee. If the deal is blocked by regulators, Netflix would pay WBD a $5.8 billion breakup fee.

The post Netflix Revises Warner Bros. Discovery Deal to $27.75 Per Share, All-Cash Offer appeared first on TheWrap.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0