FCC Chair Sees ‘Competition Concerns’ With Netflix–Warner Bros. Merger

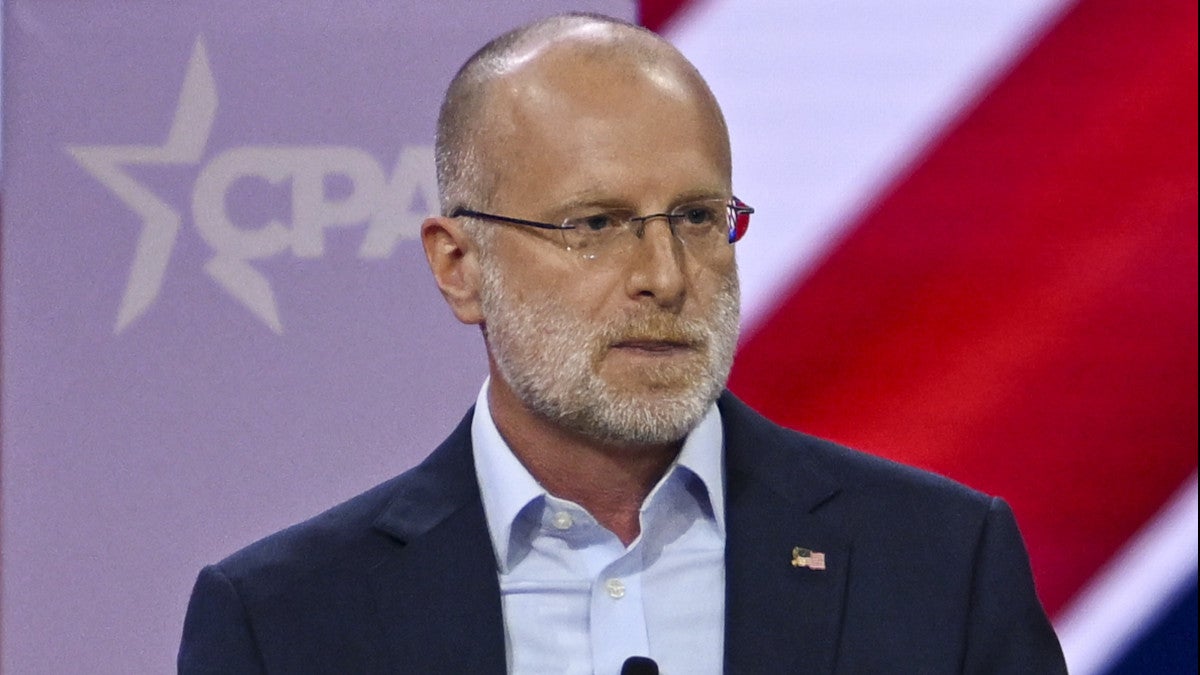

FCC chairman Brendan Carr has become the latest to warn of potential competition concerns that could arise due to Netflix’s $83 billion deal for Warner Bros. Discovery’s studio and streaming assets.

“What you’ve seen Netflix do as a general matter, in terms of their organic growth, is fantastic,” Carr told Bloomberg in an interview on Friday. “There are legitimate competition concerns that I’ve seen raised about their acquisition here and just the sheer amount of scale and consolidation you can see in the streaming market.”

Netflix has a total of 325 million paid subscribers, while Warner Bros. Discovery has a total of 128 million subscribers globally as of the end of its third quarter of 2025. WBD’s streaming results include HBO Max, HBO cable subscribers and Discovery+, the latter of which will be spun off with Warner’s cable networks into Discovery Global in the next six to nine months.

The FCC notably does not regulate Netflix nor Warner Bros. Discovery, as neither has a broadcast network. Netflix is currently engaging with the Department of Justice and the European Commission. Other regulators who can scrutinize the deal include the Federal Trade Commission and the United Kingdom’s Competition and Markets Authority.

Netflix has said it expects its deal to close within 12 to 18 months.

Carr’s remarks come as both sides of the political aisle have expressed antitrust concerns over the deal, from Republicans like Darrell Issa and Mike Lee to Democrats like Elizabeth Warren.

The House Judiciary Committee’s Subcommittee on Administrative State, Regulatory Reform and Antitrust held a hearing earlier this month to “start a much-needed conversation about whether further consolidation in the streaming industry would be helpful or harmful to consumers.” The hearing saw a panel of experts field questions about the Netflix and Paramount bids for Warner Bros. Discovery and how they would impact consumers, prices and jobs in Hollywood.

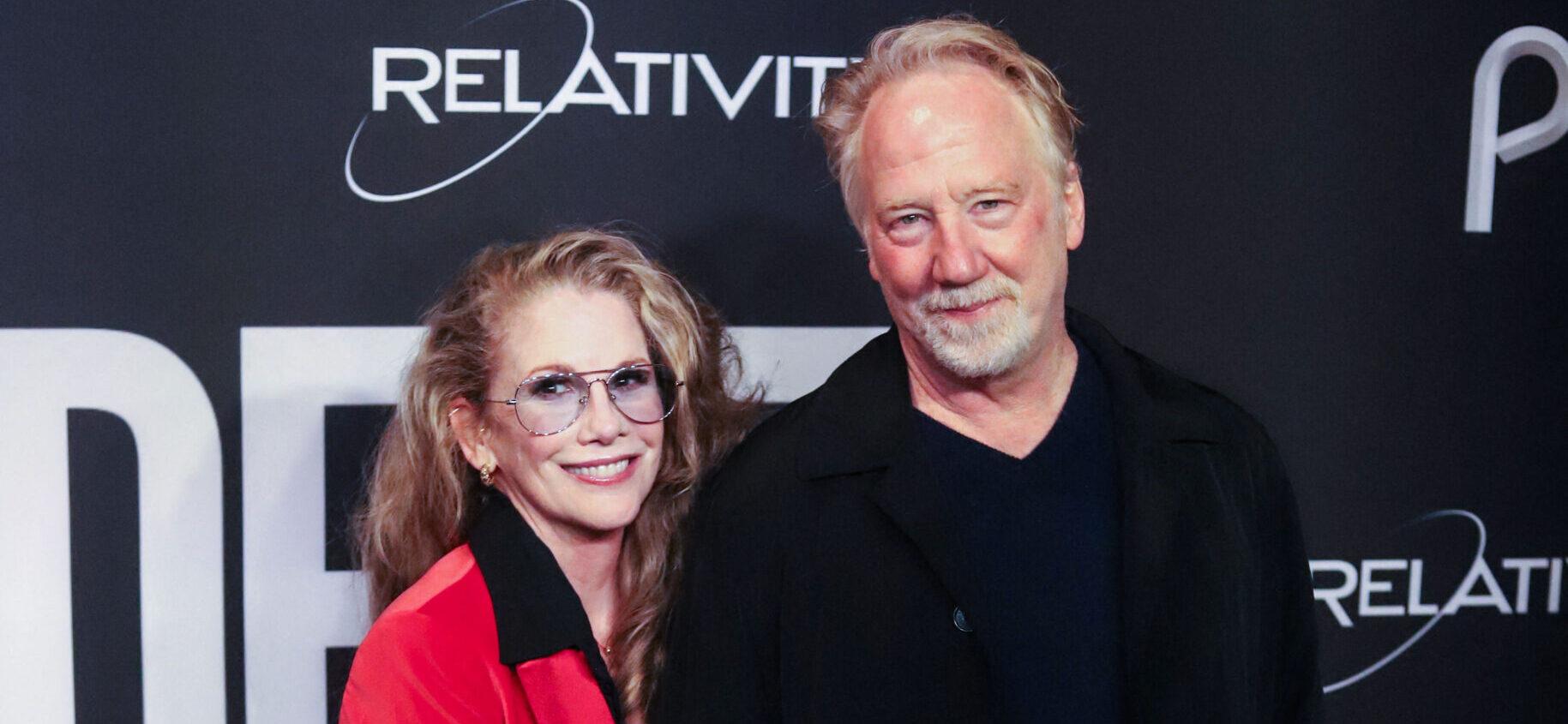

Netflix co-CEO Ted Sarandos and Warner Bros.’ chief strategy officer Bruce Campbell will also testify at a Senate antitrust hearing in February.

Paramount, which has launched a $108.4 billion hostile takeover in an attempt to thwart the Netflix deal, has claimed that the Netflix-Warner Bros. deal would “materially entrench” the streamer’s market dominance.

The David Ellison-led media giant estimates that the deal would give Netflix a 43% share of global SVOD subscribers and lead to higher prices for consumers, reduced compensation for content creators and talent, and significant harm to American and international theatrical exhibitors.

Paramount also said that Netflix’s regulatory path is “particularly challenged” in Europe, where it’s “by far the dominant streaming service and where WBD’s HBO Max is its only viable international competitor.”

“Netflix has unsuccessfully sought to address these concerns by putting forward a non-credible market definition of the streaming market that includes services like YouTube, TikTok, Instagram and Facebook and that no regulator has ever accepted,” the company added. “By contrast, the combination of Paramount and WBD is pro-competitive, with moviegoers, studio workers and creative talent all set to thrive thanks to the combined company’s expanded theatrical film production and content.”

Paramount has said it expects a potential deal with WBD to close within a year. But Carr told Bloomberg there is a scenario in which the FCC may have to review a Paramount-Warner Bros. deal, due to its plans to raise money from three Middle Eastern sovereign wealth funds.

During Netflix’s fourth quarter earnings call, co-CEO Greg Peters said the company is still under 10% of TV time in all major markets where it competes, a core argument as it tries to convince regulators that it’s not a TV giant.

“We’ve got hundreds of millions of households around the world still to sign up,” Peters said. “We’re just about 7% of the addressable market in terms of consumer and ad spend. So tons of room ahead of us.”

Sarandos added that the deal will allow the company to significantly expand production capacity in the U.S., keep investing in original content long-term and offer more jobs and opportunities to creative talent. He also pointed to growing competition in the market, from YouTube bidding on the Oscars and the NFL to Amazon owning MGM, Apple competing for the Emmys and Oscars and Instagram “coming next” with plans to bring its Reels offering to TVs.

Shareholders are expected to vote on the Netflix deal by April, although they could decide even earlier. A threshold of just 20% of WBD shareholders who have held the stock for at least a year would be needed to call a special meeting before then.

The post FCC Chair Sees ‘Competition Concerns’ With Netflix–Warner Bros. Merger appeared first on TheWrap.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0