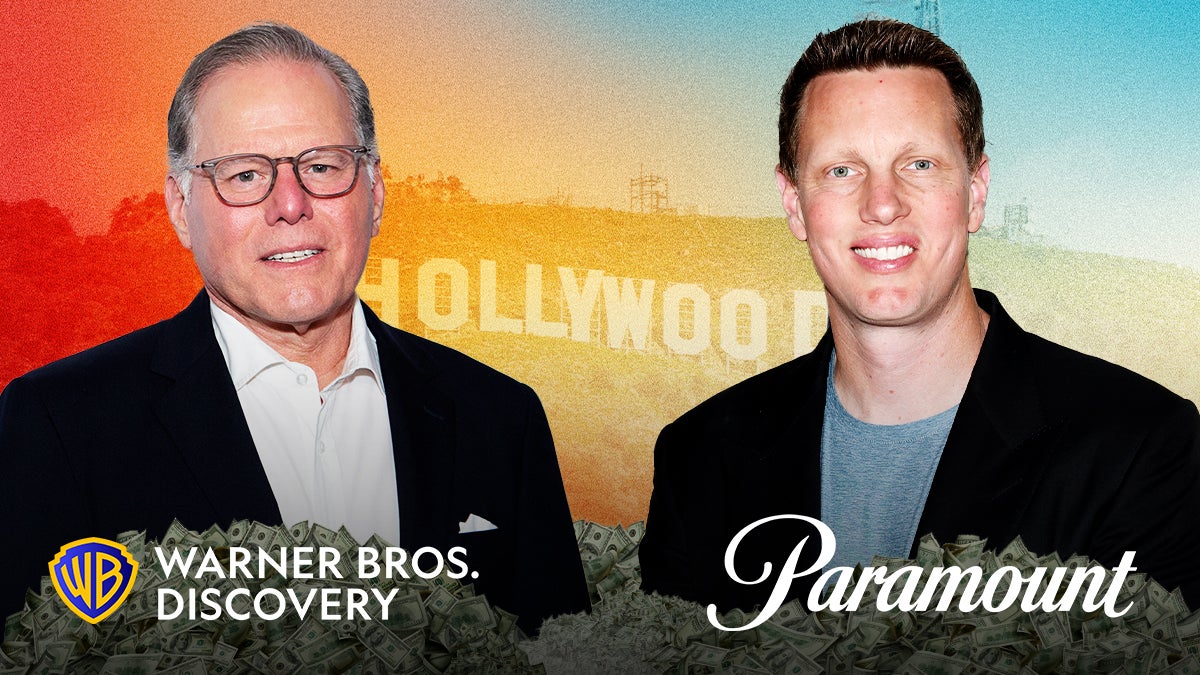

Warner Bros. Plans to Reject Paramount’s Latest Bid Despite Larry Ellison’s ‘Irrevocable Personal Guarantee’

Warner Bros. Discovery plans to reject Paramount’s revised takeover proposal despite billionaire Larry Ellison’s agreement to provide an “irrevocable personal guarantee” backing the $108 billion hostile bid, TheWrap has learned.

Paramount adjusted its hostile takeover bid last week to reassure shareholders of its financing and raise its breakup fee to $5.8 billion.

WBD’s board still views its $83 billion deal with Netflix as the better offer, according to the Financial Times. The board has not made a final decision.

The amended offer comes after WBD’s board rejected its all-cash, $30 per share bid, calling it “inadequate” and “illusory.” The bid marked its sixth proposal made over the course of twelve weeks.

Paramount’s sixth bid includes a total of $40.7 billion in equity financing, including $11.8 billion from the Ellison family and $24 billion from Saudi Arabia’s Public Investment Fund, the Qatar Investment Authority and Abu Dhabi’s L’imad Holding Company, according to a filing with the U.S. Securities and Exchange Commission. Kushner’s Affinity Partners had contributed $200 million prior to backing out, according to the New York Times. At the time, the Ellisons and Gerry Cardinale’s RedBird Capital Partners agreed to fully backstop 100% of the equity financing through the Ellison family trust.

It also includes $54 billion in committed debt financing from Bank of America, Citibank and Apollo Global Management. Roughly $17 billion had been reserved to allow WBD to extend an existing bridge loan.

A spokesperson for Warner Bros. Discovery did not immediately return TheWrap’s request for comment.

Bloomberg first reported the news.

The post Warner Bros. Plans to Reject Paramount’s Latest Bid Despite Larry Ellison’s ‘Irrevocable Personal Guarantee’ appeared first on TheWrap.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0