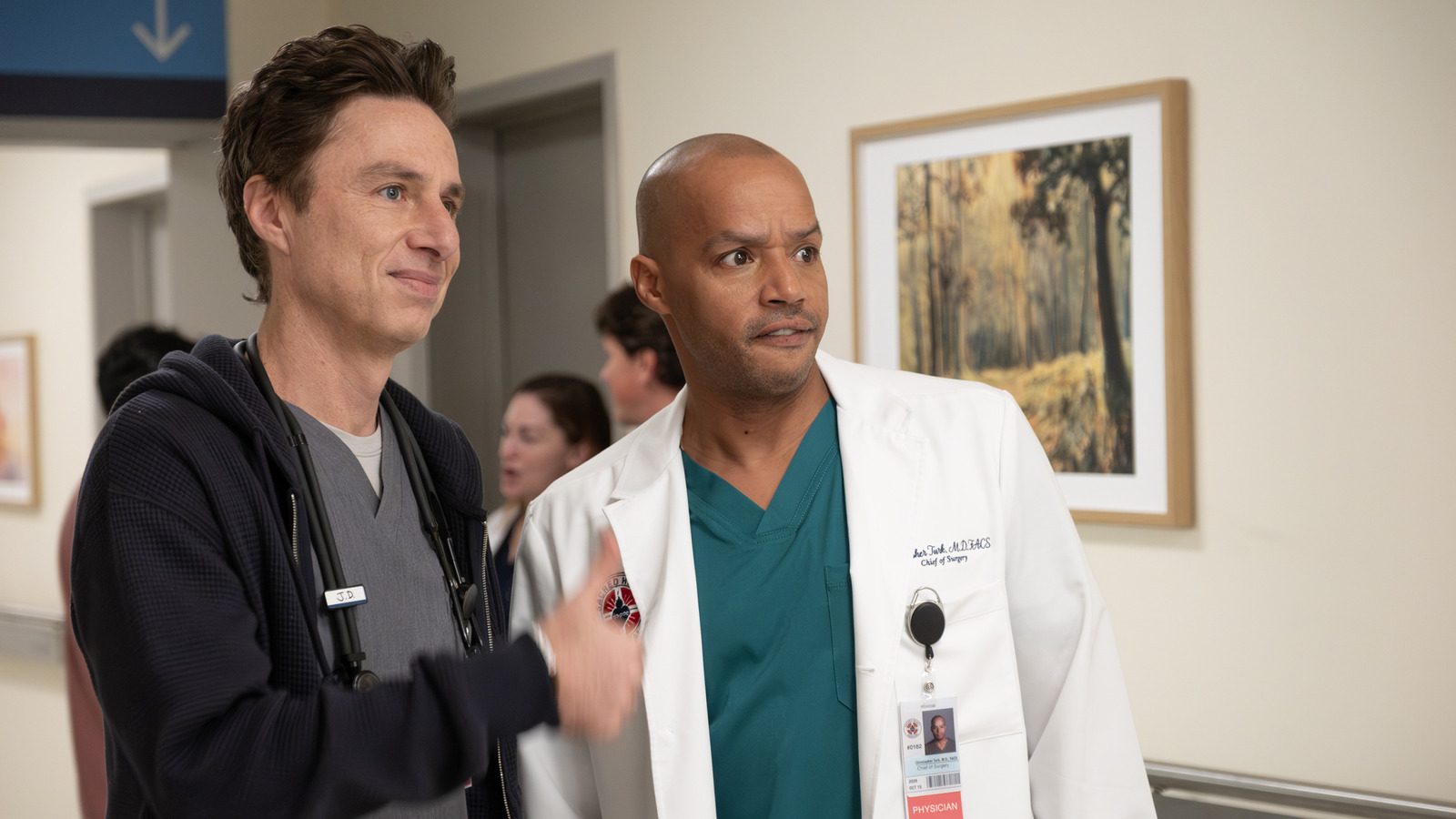

Netflix Co-CEO Greg Peters Says Paramount’s WBD Bid ‘Doesn’t Pass the Sniff Test’

Netflix co-CEO Greg Peters has taken aim at Paramount’s hostile takeover bid for Warner Bros. Discovery, arguing that the $30 per share offer “doesn’t pass the sniff test.”

“That’s what the Warner Brothers board determined,” the executive told the Financial Times. “And I think that’s where the Warner shareholders are at too.”

Around 168.5 million shares have been tendered as of Wednesday, representing just 7% of WBD’s 2.48 billion outstanding shares.

The $108.4 billion bid is backed by Oracle co-founder Larry Ellison’s irrevocable personal guarantee towards $40.4 billion of the equity financing, and $55 billion in debt financing from Bank of America, Citigroup and Apollo Global Management. Its other equity partners include RedBird Capital Partners and three Middle Eastern sovereign wealth funds.

“Without Larry Ellison independently financing this thing, there’s no chance in hell Paramount would ever be able to pull this off,” Peters said.

He noted that Paramount is already “saddled with quite a lot of debt” and that the additional leverage needed to finance a deal is “pretty crazy.”

“If they were to move [higher], what kind of leverage would they have to have?” Peters added. “It’s hard to imagine how that works out well.”

Paramount’s Gerry Cardinale pushed back, telling FT: ““Our leverage is nowhere near what they’re talking about. The Netflix deal is the Harry Houdini of deals.”

Paramount has extended the deadline on its tender offer to Feb. 20. Ellison has also launched a proxy fight seeking to block Netflix’s $83 billion deal and the spinoff of Warner’s cable networks into Discovery Global.

More to come…

More to come…

The post Netflix Co-CEO Greg Peters Says Paramount’s WBD Bid ‘Doesn’t Pass the Sniff Test’ appeared first on TheWrap.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0